Recent Articles

What Happens When You Have Multiple Years of Unfiled Tax Returns?

If you’ve fallen behind on filing your taxes, you’re not alone—and you’re not beyond help. Every year, thousands of Americans find themselves overwhelmed by back taxes. Whether it's due to financial hardship, disorganization, or simply life getting in the way, unfiled...

Unregistered Tax Preparer Pleads Guilty to Filing False Returns

A Maryland man has pleaded guilty to preparing and filing false tax returns, ultimately costing the IRS nearly $130,000. According to court documents, Charles Anthony Keemer, 64, of Upper Marlboro, Maryland, operated as a tax preparer without any formal education or...

IRS Statute of Limitations

If you’ve ever asked yourself how long the IRS can pursue you for unpaid taxes, you’re not alone. Many taxpayers believe that after enough time passes, their tax debt just disappears. The reality is a bit more complicated. At M.A. Rubin CPA, we help individuals and...

Can’t Pay What You Owe the IRS? This Is Your Golden Window to Act

May 2025 brings new IRS guidelines that make settling your tax debt easier through the Offer in Compromise program. Learn how to qualify—and why you should act now. IRS “Fresh Start” Initiative Quietly Updated This May The IRS has eased Offer in Compromise (OIC)...

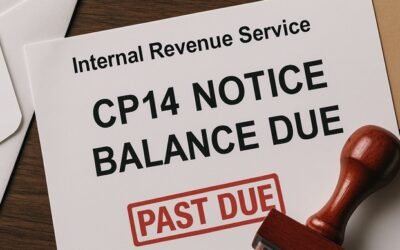

This One IRS Letter Has More People Panicking Than Ever

The IRS is sending out more CP14 notices than ever in 2025. Here's what you need to know—and how M.A. Rubin CPA, PLLC can help you resolve it before it’s too late. What Is a CP14 Notice and Why Are You Getting One Now? Starting in May 2025, the IRS has dramatically...

Reasonable Cause Penalty Abatement

If you've been hit with IRS penalties, you know how quickly they can add up—sometimes turning a manageable tax bill into a financial nightmare. The good news? You may qualify for a Reasonable Cause Penalty Abatement, which could reduce or eliminate those costly...