Recent Articles

The $500,000 Mistake: What Happens When You Try to Hide from the IRS

When taxpayers fall behind with the IRS, the temptation to stall, hide assets, or file false paperwork can feel overwhelming. But what looks like a short-term fix almost always makes things dramatically worse. A recent federal case out of Virginia offers a stark...

Can You Get the IRS to Freeze Collection?

Receiving an IRS notice when you simply cannot afford to pay is one of the most stressful situations a taxpayer can face. If your monthly income is already stretched thin covering basic necessities, making payments toward a tax debt may feel impossible — because it...

Start 2026 Right: Turn IRS Tax Problems Into a Resolution Plan

As 2026 begins, many taxpayers and business owners are opening a pile of IRS envelopes that never truly went away last year. Unfiled returns, unpaid balances, and ignored notices tend to grow into larger problems as penalties and interest accumulate. Starting the year...

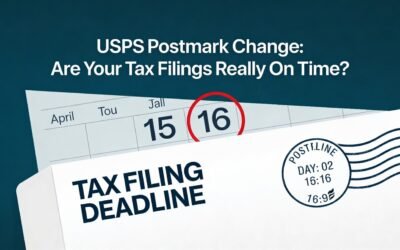

USPS Postmark Change Could Mean Late Tax Filings

As of December 24, 2025, the United States Postal Service quietly redefined how postmarks are assigned — and the change could impact tax filings, payments, and extensions starting this tax season. Under the new rule (FR Doc. 2025-20740), a postmark now reflects the...

Why December Is the Single Most Important Month for Anyone Who Owes the IRS

December is when most people panic… or pretend the IRS takes holidays off.It doesn’t. Not even for Christmas cookies. Here’s the truth the IRS won’t put on a postcard:December is the IRS’s busiest month for moving cases into enforced collection—levies, liens, and “we...

IRS Collections Don’t Stop for the Holidays — Here’s What to Do Before December 31

You know what does take time off in December?Your motivation.You know what doesn’t?IRS Collections. If you’re receiving letters, owe on old returns, or have unfiled years hanging over your head, December is the IRS’s favorite time to move cases forward. Here’s exactly...